Amazon VCS and KSeF Integration Requirements for Polish Sellers

In the dynamic world of Polish e-commerce, staying ahead of regulatory changes isn't just about compliance – it's about safeguarding your operational efficiency and maintaining growth. For many sellers on Amazon, a significant shift is on the horizon, specifically concerning the Krajowy System e-Faktur (KSeF) and how it interacts with Amazon's powerful VAT Calculation Service (VCS).

If you're leveraging Amazon's VCS for your Polish B2B sales, listen up. The way your invoices are handled is about to change, and getting it right means avoiding a potential operational nightmare. At mojo.com.pl, we understand the intricate dance between technology, commerce, and compliance. We're here to help you navigate these waters smoothly, ensuring your business not only meets new requirements but continues to thrive.

KSeF's New Mandate: What It Means for Your Amazon Sales

Let's be real: Poland's move towards mandatory e-invoicing through KSeF marks a pivotal moment for businesses. For e-commerce ventures, especially those operating on international platforms like Amazon, this means adapting your current processes to align with the new digital standard. Previously, Amazon VCS efficiently generated PDF invoices for your sales. But come February 1, 2026, the game changes for B2B transactions with a Polish NIP.

The core of the matter? Every domestic sales invoice for B2B transactions must now be sent to the KSeF system in a structured XML format. This isn't just a technical tweak; it's a legal mandate. For Amazon to continue generating these invoices on your behalf, it needs your explicit authorization to communicate directly with KSeF.

Without this crucial authorization, Amazon's VCS simply won't be able to fulfill its function for B2B invoices subject to KSeF rules. This leaves you, the seller, with the full responsibility – and burden – of manually generating and submitting these documents. Nobody wants that, right?

The Critical Dates: Mark Your Calendar for KSeF Compliance

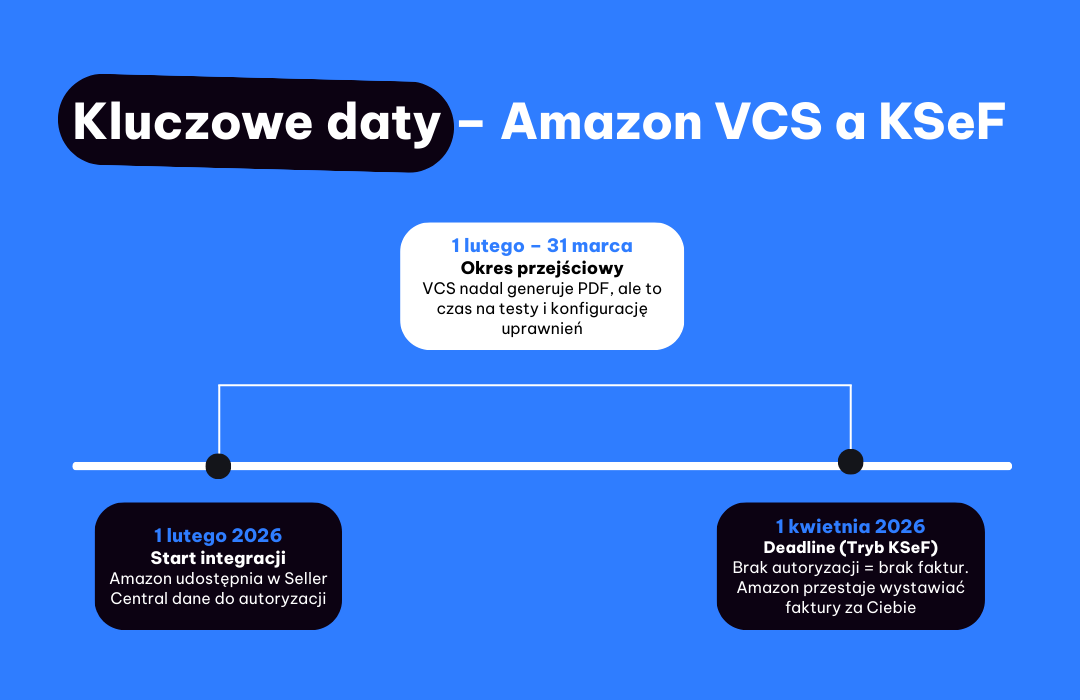

The transition isn't sudden, thankfully. There's a structured timeline to help you prepare, but don't mistake that for an invitation to procrastinate. These are the dates you absolutely need to keep in mind to ensure smooth system integration and avoid compliance issues:

- February 1, 2026: KSeF Integration Goes Live. This is the starting gun. Amazon VCS will officially begin supporting KSeF. From this day forward, you can link your seller account with the government's application.

- Up to March 31, 2026: The Grace Period. If you haven't granted authorization yet, VCS will still generate PDF invoices in the old format. Think of this as your last chance to get your ducks in a row.

- April 1, 2026: The Hard Deadline. This is it. If Amazon isn't authorized in KSeF by this date, VCS will completely cease generating invoices for your Polish B2B orders. The full responsibility for issuing these documents – manually or via an external system – falls squarely on your shoulders.

Authorizing Amazon in KSeF: Your Step-by-Step Pathway

The process of authorizing Amazon isn't something you'll find buried deep in your Seller Central settings. It happens directly within the Polish government's official KSeF infrastructure. Here’s a simplified breakdown:

- Access the KSeF Taxpayer Application: Head over to the official Ministry of Finance KSeF portal. This is your gateway.

- Navigate to Permissions: Look for the section dedicated to granting permissions for third parties.

- Grant Authorization to Amazon: You'll need to empower Amazon (as an entity authorized to issue electronic invoices) to act on your behalf. Amazon will provide the specific identification details needed for this step within your Seller Central dashboard closer to the effective date.

- Verify in Seller Central: Once authorization is complete in KSeF, double-check your Amazon Seller Central. The status of your VCS service should update to reflect KSeF compliance.

Sounds straightforward, but we know these government portals can sometimes be a bit tricky. That's why having expert guidance can make all the difference for your e-commerce operations in Poland.

The Cost of Inaction: Why Delaying KSeF Authorization Will Hurt Your Business

Ignoring these changes or delaying action can have significant, and frankly, costly repercussions for your e-commerce business in Poland:

- Operational Gridlock: Imagine having to manually process hundreds, even thousands, of B2B invoices in KSeF every month. This isn't just tedious; it's a massive drain on resources and a recipe for errors. This kind of manual workload is no small feat and severely impacts your operational efficiency.

- Compliance Penalties: Missing the KSeF mandate means non-compliance with Polish tax law, which can lead to substantial fines and legal complications. Ensuring tax compliance is paramount.

- Damaged Customer Relations: B2B clients expect timely and accurate invoices. Delays due to manual processing can lead to dissatisfaction, negative reviews, and potentially lost business, especially with Amazon Business clients. A seamless customer experience is crucial.

- Resource Diversion: Your team's valuable time will be diverted from strategic growth activities to remedial administrative tasks. This impacts overall business scalability and profitability, hindering your SEO efforts and broader marketing strategies.

Mojo.com.pl: Your Partner for KSeF & E-commerce Success

At mojo.com.pl, we're not just about building great websites or running stellar ad campaigns. We're about providing comprehensive digital strategy that includes crucial aspects like system integration and accounting automation. Navigating KSeF, Amazon VCS, and other regulatory shifts is exactly where our expertise shines.

We can help your business by:

- Strategic Planning: Crafting a clear roadmap for KSeF compliance and Amazon VCS integration, ensuring your e-commerce content strategy aligns with operational realities.

- Technical Guidance: Assisting with the authorization process and ensuring your systems are correctly configured for mandatory e-invoicing.

- Process Optimization: Reviewing your existing e-commerce workflows to minimize disruption and maximize efficiency post-KSeF.

- Peace of Mind: Letting you focus on what you do best – growing your business – while we handle the complexities of regulatory compliance.

Don't let these regulatory changes become a stumbling block. Instead, see them as an opportunity to streamline your operations and solidify your position in the competitive Polish e-commerce landscape.

Ready to Ensure KSeF Compliance and E-commerce Growth?

The clock is ticking, but there's still time to prepare. Proactive action now will save you headaches, resources, and potential penalties down the line. We recommend addressing these formalities in the first half of February to avoid the potential rush and system overload in March.

Got questions about KSeF, Amazon VCS, or need comprehensive support for your e-commerce operations? Let's talk! Our team of experts is ready to provide tailored solutions and strategic advice to keep your business running smoothly and profitably.

Don't wait until April 1st. Contact mojo.com.pl for a personalized consultation today! Let's build a robust, compliant, and thriving future for your e-commerce business in Poland.